Financial crisis

Carping about the TARP

Congress wrangles over how best to avoid financial Armaggedon

IF ONLY, America’s financial authorities must feel, they could gag congressmen as easily as they have muzzled short-sellers. Financial markets around the world were choppy this week as Republicans and Democrats wrangled over the $700 billion rescue plan for Wall Street proposed last week by Hank Paulson, America's treasury secretary.

One fear is that Mr Paulson’s troubled asset relief programme (TARP) will be blocked on Capitol Hill. That is possibly overdone: the risk of being blamed for plunging the world’s greatest economy into financial ruin is a good incentive for all sides to reach a compromise. Of more concern is that the plan, if it were approved, would neither shore up the financial system nor save the American economy. On that point there is room for argument, and hence for more uncertainty in the markets.

Mr Paulson’s plan is to use public money to buy assets from banks whose value has slumped with every lurch downwards in America’s housing market and which have been shunned by the private sector. With a floor put under the value of those instruments it should be easier for banks to raise capital. Without capital, and amid relentless write-downs on those toxic assets, banks would have to curtail lending, causing a massive credit drought in America. That would not only further batter the housing market. It might also push companies into bankruptcy, too, causing mayhem in the $62 trillion market for credit derivatives.

“Despite the efforts of the Federal Reserve, the Treasury and other agencies, global financial markets remain under extraordinary stress,” Ben Bernanke, chairman of the Federal Reserve, said in prepared remarks for a hearing of the Senate Banking Committee on Tuesday September 23rd. “Action by Congress is urgently required to stabilise the situation and avert what otherwise could be very serious consequences for our financial markets and for our economy.”

Few dispute the potential threat; the demise of a 75-year-old investment-banking model on Wall Street in just a few days shows the financial system to be vulnerable. But there is plenty for everyone to dislike about aspects of Mr Paulson’s plan. It could safeguard irresponsible bankers’ jobs, while doing little to stop troubled mortgage debtors from being thrown out of their homes. It seeks to invest massive power in a treasury secretary with a lifelong loyalty to Wall Street. The banks with the worst assets (ie, those which have made the worst decisions) could receive the most help. Most disturbing, the taxpayer will be funding an enormous, ill-defined programme, without any stipulation as yet that the banks who orchestrated the mess will pay a penalty.

All those points have been raised in Congress by legislators who are understandably fearful of the political consequences of bailing out Wall Street. But there is a legitimate riposte. The more restrictions they put on the bail-out, the more likely it will emerge as a messy fudge, lacking the wallop necessary to put the banks on a more stable footing.

Financiers have different concerns. If the TARP seeks to buy assets too cheaply, banks will not take part. If prices are too high, the taxpayer may lose out. Even if the purchase of toxic assets goes ahead, might banks remain undercapitalised? Some have proposed a parallel scheme in which the government would take shares (or warrants) in troubled banks, if necessary, to build up their capital. This might be unnecessary. The TARP could be extended to allow the purchase of bank shares if necessary, or even of mortgages, which might allay some of the fears of homeowners.

With enough force, it could prevent financial Armageddon. But it may also prolong the period necessary for asset prices to reach their natural floor, dragging out the crisis. With such high stakes involved, it is no wonder that markets are on their toes. Bank shares led a slump in European and Asian stock markets on Tuesday, though the Dow Jones Industrial Average opened slightly higher after an oil rally on Monday petered out. Three-month interbank spreads in London loosened from the extraordinarily tight levels of last week, but were still “at highly stressed levels,” according to Morgan Stanley. The dollar, meanwhile, was slightly stronger against the euro after four days of decline. How long it can remain as firm as it is, with the Treasury pumping money into all manner of financial assets with possible inflationary consequences, is one question the markets are not keen to address.

Commentary by William Pesek

Sept. 24 (Bloomberg) -- Taking a break from Macau's teeming card tables one recent evening, four mainland Chinese men sip beer and warily eye two televisions above the bar.

The TVs are tuned to competing business news channels -- one covering the demise of Lehman Brothers Holdings Inc., the other this year's 60 percent plunge in Chinese stocks. Eventually, the gamblers shake their heads and go back across the hall to the Venetian Macau's casino floor.

The juxtaposition aptly brought together some of the world's most gripping economic stories and one of its more intriguing social trends, the latter being the surging popularity of gambling in Asia.

It's getting harder to separate Wall Street's plunge and the meltdown in Chinese stocks. It's also likely that Macau will join Las Vegas in dispelling the conventional wisdom that gambling is a recession-proof business.

A year ago, few quibbled with Macau bulls such as Steve Wynn, Sheldon Adelson and, long before the Vegas tycoons showed up, Stanley Ho. Given Macau's proximity to a nation of 1.3 billion potential gambling enthusiasts, it's still hard to bet against this former Portuguese colony.

Yet some important changes are afoot, including the global economic environment. The U.S. is on the verge of a recession and China is bracing for a marked slowdown in its economy.

Weakening growth is hurting stock markets and also showing that Vegas isn't immune to macroeconomics after all.

Measuring Adelson

One measure: Adelson was the biggest loser in this year's Forbes ranking. The Las Vegas Sands Corp. chief executive officer fell to 15th place from third after casino stocks tumbled. Another: Vegas Strip casino gambling revenue dropped for the seventh straight month in July as cash-strapped U.S. consumers curbed entertainment and travel spending. Revenue declined 15 percent in July alone.

A variable that may change is the flow of mainland Chinese to Macau. Shares of Las Vegas Sands, Wynn Resorts Ltd., MGM Mirage, and Melco Crown Entertainment Ltd. dropped in August on news reports that China may increase travel restrictions to what's now the world's biggest gambling center.

Macau's casino gambling revenue rose 55 percent in the first six months of 2008, accelerating from 47 percent growth in 2007.

Will Macau suffer Lehman's fate -- a place oozing confidence a year ago that has now gone bust? It's doubtful, yet the risks suddenly facing Macau tell a few bigger stories.

Knock-On Effects

One is how the ripple effects of the U.S. credit crisis are traveling far and wide. Another is the hubris with which analysts argued that Asia had decoupled from the U.S. Perhaps the most important is the Asia-wide risk of relying so heavily on China, which is itself a developing nation.

The plunge in Chinese shares speaks to the danger of developing economies depending on another emerging one. Macau relies on so-called VIP gamblers. The drop in stocks may mean fewer high-rollers will come Macau's way.

Macau returned to Chinese rule in 1999, and its torrid early growth is being followed by a slowdown in expansion efforts. One might argue Macau is merely taking a much-needed breather. Its casinos have more than doubled to 30 since the government ended billionaire Ho's 40-year monopoly in 2002 and awarded licenses to five other operators.

When I asked Lawrence Ho, Stanley Ho's son and one of Melco Crown Entertainment Ltd.'s two chairmen, about this recently, he pointed out that the only place in China where casinos are legal still lacks the airport and ferry capacity to support its growth.

Deep Breath

``Macau is just taking a deep breath at the moment -- nothing more,'' Ho says.

Macau's tourism growth may even support another 16 casinos in the next three to four years if the government builds enough transport infrastructure, says Paul Tso, chief executive officer of property developer L'Arc Macau.

``The growth of incoming tourists, gamblers or not, has way outpaced everything the government has implemented,'' says Tso, whose company is developing the 56-storey L'Arc de Triomphe, Macau's tallest casino project, for about $600 million.

Yet the question of whether U.S. casino operators will change Macau, or if the place changes them, hasn't been answered. Walking around the sprawling luxury-shopping centers tacked on to the Venetian Macau and the new Four Seasons complexes, one gets the impression that Vegas is still struggling to influence Macau. The buildings are lonely, sparsely populated places.

Vegas is as much an entertainment destination as a gambling center. Those tapped out at the tables -- or uninterested -- see shows, shop, take in local attractions or dine at any number of top eateries. Many visitors to Macau don't bother getting hotel rooms or eating out, never mind checking out Louis Vuitton, Prada or Gordon Ramsey's menu.

Efforts to change things are certainly brewing. The planned Vegasization of Macau can be seen in the ambitions of Adelson's Las Vegas Sands, with almost a fifth of Macau's casino market. Adelson plans to invest $12 billion in project.

The odds are in Macau's favor. The effects of a bust on Wall Street make it a riskier bet.

China, Venezuela Enter Joint Effort

For Oil Refineries

BEIJING -- China and Venezuela agreed to jointly build two oil refineries, one in each country, Venezuelan President Hugo Chavez said Tuesday.

Speaking to journalists on the first day of a two-day official visit to China, Mr. Chavez said the refinery to be built in Venezuela will be located in the oil-rich region of the Orinoco Basin. A formal agreement on the issue is expected to be signed during Mr. Chavez's stay in China.

China is already building a refinery to process Venezuelan oil, following an agreement reached this year. Mr. Chavez didn't provide details on when or where the second Chinese refinery would be built.

"Venezuela has enough oil to last for two hundred years," Mr. Chavez said. "And the Chinese are already working to tap that."

He hopes to boost ties with China through increased oil sales, partly to reduce dependency on the U.S., which still buys about 60% of Venezuelan exports despite years of tensions.

"China is showing the world that it isn't necessary to harm anyone to be a great power. They are soldiers of peace," he said, according to a Venezuelan government statement. Asked about his absence from talks this week on the sidelines of the United Nations in New York, Mr. Chavez said: "It's much more important to be in Beijing than in New York."

China is the second stop in a six-country tour that Mr. Chavez started in Cuba on Sunday. Mr. Chavez and his Chinese counterparts are also expected to discuss a joint $6 billion investment fund the two sides agreed to this year. He plans to fly Thursday to Russia, and then to go on to Belarus, France and Portugal.

The trip comes amid a stepped-up confrontation with the U.S., including Russia's dispatch Monday of a naval squadron to hold joint maneuvers with Venezuela's navy. The deployment of Russian military power to the Western Hemisphere is unprecedented since the Cold War and follows a weeklong visit to Venezuela by a pair of Russian strategic bombers.

"The only thing we demand is that our nation be respected," Mr. Chavez said. "We're no longer the backyard of the United States."

Sept. 23 (Bloomberg) -- Congressional leaders in both parties are struggling to find support among House lawmakers for a $700 billion rescue plan for troubled financial firms pushed by Treasury Secretary Henry Paulson and Federal Reserve Chairman Ben S. Bernanke.

Congressional testimony today by Bernanke and Paulson and a visit to Capitol Hill by Vice President Dick Cheney may not have persuaded a majority of either party to back the rescue plan, lawmakers said.

``Hardly anyone in that room has decided yet how they're going to vote on this,'' Representative Phil Gingrey, a Georgia Republican, said after Republicans met with Cheney.

Whether a majority of Democrats will support it is ``up in the air right now,'' said Representative Chris Van Hollen of Maryland, chairman of the Democratic Congressional Campaign Committee.

House Republican and Democratic leaders have endorsed quick action on the plan to allow the Treasury to purchase troubled investments in order to prevent further economic turmoil.

House Speaker Nancy Pelosi said progress is being made between House Financial Services Committee Chairman Barney Frank and Paulson on a compromise that could bolster oversight of Treasury's expanded authority and limit compensation of executives of companies that get government aid.

Move Legislation

House Majority Leader Steny Hoyer said Democratic leaders still are aiming to move the legislation this week.

Hoyer said the final measure will include a cap on executive pay. The Bush administration, which has resisted that idea, is likely to go along with it in the end, Hoyer said.

Republican leaders said the action is necessary to shore up the banking system.

``This is a Main Street problem,'' said House Republican Whip Roy Blunt of Missouri. ``This is a systemic solution going to the root of the problem.''

Many lawmakers said they weren't convinced.

``I am very uneasy with the proposal to spend a trillion dollars to buy illiquid assets, toxic securities from large financial institutions and have the taxpayers pay for that,'' said Representative Spencer Bachus, the top Republican on the House Financial Services Committee.

``There is growing discontent among Republicans, that was very evident,'' said Representative Mike Pence of Indiana, a member of a self-described conservative group of more than 100 House Republicans.

`Anxiety'

Representative John Yarmuth, a Kentucky Democrat, said Democratic leaders may give lawmakers more time to consider the issue.

``There is a lot of anxiety that we're being pressured into making a decision that should take more time,'' Yarmuth said.

Bernanke, in testimony today, said failing to intervene in the financial markets will spread the economic pain throughout the nation.

``I believe if the credit markets are not functioning, that jobs will be lost, the unemployment rate will rise, more houses will be foreclosed upon, GDP will contract, that the economy will just not be able to recover,'' Bernanke told the Senate Banking Committee today. ``My interest is solely for the strength and recovery of the U.S. economy.''

Senator Christopher Dodd of Connecticut, after listening to Bernanke and Paulson testify at the Senate Banking Committee he heads, said Democrats would demand changes to the plan.

`Not Acceptable'

``What they sent us is not acceptable,'' Dodd told reporters. ``All of us have serious questions.''

Senate Majority Leader Harry Reid, a Nevada Democrat, expressed concern that congressional Republicans are backing away from a plan formulated by their own party. ``We need now for the Republicans to start producing some votes for this,'' said Reid.

Senate Republicans said the Bush administration needs to sell the proposal better to address voters' concerns about the cost and the value of the asset buyout program.

``As long as this is portrayed as a bailout for Wall Street it's a loser,'' said Texas Senator John Cornyn. It's important for proponents to ``explain why it's important for working families in the country.''

Senator Charles Schumer, a New York Democrat, said he supports reducing the burden on taxpayers by ``looking at passing only a first installment, and by considering an FDIC-style setup for financial institutions to defray some of the costs.''

Reservations

At a meeting this morning, Cheney appealed to Republicans in Congress to put aside their reservations and support the plan.

Cheney urged action on the proposal this week and warned of a dire impact on financial markets if action isn't swift. Gingrey said the financial system was described as being in ``gridlock,'' with institutions unwilling to make loans.

``They said we really only have days and not weeks to do something big and bold,'' said Representative Zach Wamp, a Tennessee Republican.

Republicans are wary of giving Paulson far-reaching new financial power, Gingrey said, given the administration's inability to find the weapons of mass destruction it said were in Iraq, and its much-criticized response to Hurricane Katrina.

Sept. 23 (Bloomberg) -- U.S. stocks fell in the market's worst two-day slump in six years on concern Congress will hold up a $700 billion bank bailout that Federal Reserve Chairman Ben S. Bernanke said is critical to preventing a recession.

General Motors Corp., Dillard's Inc. and Regions Financial Corp. tumbled more than 7 percent after members of the Senate Banking Committee expressed skepticism about Treasury Secretary Henry Paulson's plan. General Electric Co., the world's third- biggest company, retreated 4.6 percent as Merrill Lynch & Co. downgraded the stock on ``growing fundamental pressures.'' ConocoPhillips and Newmont Mining Co. lost more than 3 percent as oil, gold and copper prices decreased.

The Standard & Poor's 500 Index slid 18.87 points, or 1.6 percent, to 1,188.22, capping a two-day decline of 5.3 percent. The Dow Jones Industrial Average lost 161.52, or 1.5 percent, to 10,854.17, erasing a 128-point rally. The Nasdaq Composite Index declined 25.64, or 1.2 percent, to 2,153.34. Almost three stocks fell for each that gained on the New York Stock Exchange.

``The credit crunch is going to become far more severe than anybody thought two weeks ago,'' said Tom Wirth, senior investment officer at Chemung Canal Trust Co. in Elmira, New York, which manages $1.7 billion. ``In my opinion this is not understood by the politicians in Washington.''

`Universally Negative'

The S&P 500 swung between gains and losses at least 25 times as Bernanke and Paulson urged swift passage of the bailout measure, while lawmakers expressed objections. Senator Sherrod Brown, a Democrat from Ohio, said his constituents hold a ``universally negative'' opinion toward the proposal, while Senator Jim Bunning, a Kentucky Republican, said the plan would ``take Wall Street's pain and spread it to the taxpayers.''

GM, the largest U.S. automaker, tumbled 7.4 percent to $10.72. Dillard's, the Arkansas-based department-store chain, retreated 9 percent to $11.53.

Regions Financial, Alabama's biggest bank, tumbled 12 percent after a 21 percent retreat yesterday. Citigroup cut the lender to ``sell'' from ``hold,'' sayings its current valuation is ``not in line with fundamentals.''

All 10 of the major industries in the S&P 500 declined, with seven groups losing more than 1 percent.

Banks Tumble

The S&P 500 Banks Index retreated 3.1 percent. The index plunged 12 percent yesterday, the most since the gauge was created in 1989. Oppenheimer & Co. analyst Meredith Whitney lowered her earnings estimates for U.S. banks, predicting U.S. home prices may fall an additional 25 percent and saying the government bailout holds ``little hope of improving core fundamentals over the near and medium term.

Bank of America Corp., the second-biggest U.S. bank by assets, led declines among large financial companies with a 2.5 percent retreat to $33.30.

GE lost $1.20 to $24.95. The company was cut to ``neutral'' from ``buy'' at Merrill. The company's GE Capital unit is facing ``growing fundamental pressures,'' Merrill analysts wrote in a report. They lowered their 2009 and 2010 earnings per share forecasts and their share-price projection.

Zions Bancorporation fell 14 percent to $40.54 for the biggest drop in the S&P 500. Citigroup downgraded the Salt Lake City-based lender with operations in 10 Western states to ``hold'' from ``buy.''

The bailout under consideration is ``helpful, but it's not going to prevent a recession if we're in one, or cause people to pay back loans that they couldn't otherwise pay back,'' David King, a money manager at Putnam Investments in Boston, said on Bloomberg Television. Putnam manages $163 billion.

Energy, Material Producers

ConocoPhillips, the third-largest U.S. energy company, declined $3.14 to $74.58. Newmont Mining, the biggest U.S. gold producer, tumbled $1.66 to $42.77. Energy companies in the S&P 500 lost 2.9 percent as a group, while raw-materials producers decreased 3.2 percent.

Crude oil fell for the first time in a week, losing $2.76 to $106.61 a barrel in New York, after rallying a record 16 percent yesterday. Copper declined the most in two weeks as the dollar rebounded following its steepest slide against the euro in seven years, reducing the appeal of metal as a hedge against inflation. Gold fell below $900 an ounce.

Airlines and railroads rallied on cheaper fuel. Southwest Airlines Co., the largest discount airline, added 47 cents to $15.23. Union Pacific Corp., the biggest U.S. railroad, climbed 87 cents to $73.73.

General Growth Properties Inc. rallied 5.7 percent to $17 after U.S. regulators added the real-estate investment trust and eight other companies to the list of stocks temporarily protected against short sales.

The S&P 500 lost 3.8 percent yesterday on concern the bailout plan won't forestall a recession as a surge in oil further undermined confidence in the economy.

Rally Pared

The slide in the S&P 500 yesterday and today erased about two-thirds of an 8.5 percent, two-day rally at the end of last week that was the S&P 500's biggest since the aftermath of the crash of 1987. The gain followed a drop of 7.6 percent over the three previous days that started when Lehman Brothers Holdings Inc. filed for bankruptcy, Merrill was sold to Bank of America Corp. and the U.S. took control of American International Group Inc.

Earlier gains in the stock market today were spurred by technology shares trading at their cheapest level in at least 13 years and phone companies that don't depend on the economy's growth for profits.

Technology companies in the S&P 500 lost 1.4 percent as a group last week even as the overall index gained 0.3 percent. The S&P 500 Information Technology Index ended the week with an average valuation of 17.6 times earnings, the cheapest since Bloomberg began tracking the data in 1995.

Microsoft, Intel

The group advanced as much as 2.2 percent in early trading today before erasing the gain. Other than American Express Co., the only companies in the Dow average that rose were Intel Corp., the world's largest maker of computer chips, and Microsoft Corp., the world's largest software company.

Microsoft's authorization of a $40 billion stock buyback yesterday ``signals management's greater confidence in the long- term potential of the company,'' Deutsche Bank analysts wrote. The buyback may boost next fiscal 2009 per-share earnings by 4 cents, they wrote, maintaining a $34 share forecast.

``I'm looking for companies with very defensive business models,'' said Michael Shinnick, a money-manager at 1st Source Corp. Investment Advisors Inc. in South Bend, Indiana. Technology companies ``are less economically sensitive and have better balance sheets and cash-flow characteristics than many in the market are giving them credit for.'' 1st Source manages $3 billion, including Microsoft shares.

ImClone Takeover

ImClone Systems Inc. added 6.9 percent, the most since July 31, to $63.51. Bristol-Myers Squibb Co. increased an offer to buy 83 percent of the maker of the Erbitux cancer drug to $62 from $60 a share. ImClone rejected the $60-a-share offer July 31.

The S&P 500 is down 19 percent this year on concern more than $500 billion in credit losses and writedowns at financial firms worldwide and a slowing economy will hurt profits. Earnings for companies in the index are forecast to fall 5 percent this quarter, according to analyst estimates compiled by Bloomberg.

A decline in third-quarter profits would make this streak of decreases the longest since the period ended in 2002, the year the benchmark index for American equities completed a 49 percent plunge from its March 2000 record. The S&P 500 has lost 24 percent since its all-time high reached in October 2007.

About 1.2 billion shares changed hands on the floor of the NYSE today, about half of the average last week.

Bush Presses U.N. to Do More to Prevent Tyranny, Terrorism

NEW YORK — With Iranian President Mahmoud Ahmadinejad in the audience, President Bush used his valedictory address to the U.N. General Assembly Tuesday to warn the organization to do more to reject the tyranny and terrorism that plague many U.N. member nations.

Couching his warning in flattering language about progress that has been made to prevent terrorism so far, Bush said the nations of the world must provide opportunities for its citizens to excel — free from forced labor, discrimination and oppression.

"Multilateral organizations have responsibilities. For eight years, the nations in this assembly have worked together to confront the extremists' threat. We've witnessed successes and setbacks," Bush said.

"To be successful, we must be focused and resolute and effective. Instead of only passing resolutions decrying terrorist attacks after they occur, we must cooperate more closely to keep terrorist attacks from happening in the first place. Instead of treating all forms of government as equally tolerable, we must actively challenge the conditions of tyranny and despair that allow terror and extremists to thrive," he continued.

Fresh off a meeting with Pakistan's new president, Asif Ali Zardari, whose country saw 53 killed over the weekend in an attack on the Marriott hotel in Islamabad, Bush made the case against inaction in the face of terrorism. He warned that tyranny is just as challenging an obstacle as terrorism.

"Syria and Iran continue to sponsor terror, yet their numbers are growing fewer. They are becoming more isolated in the world," he said. "Like slavery and piracy, terrorism has no place in the modern world." The president added that the U.N. must enforce sanctions against Iran and North Korea against proliferation. He also praised nations that have decided to observe democracy over autocracy. "In this chamber are representatives of Georgia, and Ukraine, and Lebanon, and Afghanistan, and Liberia, and Iraq, and other brave, young democracies. We admire your courage. We honor your sacrifices. We thank you for your inspiring example. We will continue to stand with all who stand for freedom. This noble goal is worthy of the United Nations, and it should have the support of every member in this assembly," he said. Stumping one angle of the "Bush Doctrine," Bush took to the world stage to promote U.S. efforts to provide opportunities for nations to continue to move toward democracy. He cited the Millennium Challenge Account, efforts to combat malaria and HIV-AIDS through the Global Fund and multilateral free trade agreements that open up markets. The president said multilateral institutions must also not back away from challenges and should work toward measurable goals and accountability. The president pointed to the U.N.'s failure to do more for people of Darfur and Myanmar, which is recognized in the world body by the junta-sponsored Burma. He added that the Human Rights Council must stop protecting violators of human rights. "In the 21st century, the world needs a confident and effective United Nations. This unique institution should build on its successes and improve its performance. Where there's inefficiency and corruption, it must be corrected. Where there are bloated bureaucracies, they must be streamlined. Where members fail to uphold their obligations, there must be strong action," Bush said. Prior to his address Bush said he has spoken with world leaders who want to know whether the U.S. has the right plan to bail out Wall Street, where a collapse of the financial sector has forced a $700 billion rescue plan. He told Pakistan's Zardari that he is confident Treasury Secretary Hank Paulson's plan is "robust" enough to deal with the economic problems that spill over into the world community, and that Congress will act. "Having spoken to the leaders of Congress from both political parties there is the desire to get something done quickly," Bush said. "Now there is a natural give and take when it comes to the legislative process. There are good ideas that need to be listened to in order to get a good bill out that will address the situation. "But I am confident, Mr. President, as I have told you and other leaders that there will be a bipartisan bill, that the Republicans and Democrats will come together to get this piece of legislation passed which is necessary to address the financial situation and provide a rescue plan to make sure there is stability in the markets," he said. Bush repeated his pledge to the entire General Assembly. He also urged the body to open its doors to "a new age of transparency, accountability and seriousness of purpose." "Today the world is engaged in a time of challenge and by continuing to work together that unshakable unity of determination will be ours," he said. Ahmadinejad will address the U.N. body later in the day. Other notable leaders in attendance at the president's speech were Israeli President Shimon Peres, Palestinian President Mahmoud Abbas, Afghanistan President Hamid Karzai and French President Nikolas Sarkozy. Sarkozy proposed an international body to review the global financial system. In seeming contradiction to Bush's plea, the French president also said he would back freezing action at the International Criminal Court of Sudan's president al-Bashir would change its tyrannical behavior. Bashir has made no previous notable effort to relieve the suffering in Darfur despite numerous pleas. Aside from the threat of terror, many economies around the world are affected by and dependent on the U.S. economy, so a great deal of interest has centered on how the U.S. economy will fare. Deputy White House Secretary Tony Fratto said Bush wants to assure other leaders that the U.S. is working in bipartisan way to get legislation passed. Fratto unequivocally said there's "no question the plan will get done this week," and a sense of urgency has gripped the bipartisan consensus that action must be taken immediately. "It would be a very very serious situation for our economy were we not to get this legislation passed," Fratto said. In meeting with Zardari for the first time, Bush expressed condolences to the victims of last weekend's Islamabad bombing and acknowledged Pakistani concerns about that country's threatened sovereignty in a meeting with Pakistan's new president Tuesday. Zardari is the widower of the late Pakistani Prime Minister Benazir Bhutto, who was killed late last year while campaigning against Pervez Musharraf. Her husband won the election in her stead. Zardari spoke briefly, thanking the president for pushing democracy in Pakistan and pledging that the country, which has been racked by Taliban insurgents given safe haven by tribal leaders on its border with Afghanistan. Pakistan's government has estimated that 90,000 people who fled recent fighting remain in North West Frontier Province along the Afghan border and a similar number are displaced in the northern part of the province. The U.N. refugee agency is asking for $17 million to help 300,000 refugees. "Democracy is the answer. We will solve all the problems. We have a situation. We have issues. We've got problems. But we will solve them and we will rise to the occasion. That's what my wife's legacy is all about. ," he said. Bush said Pakistan is an ally, and talks between the two leaders will focus on spreading prosperity. "We want our friends around the world to be making a good living. We want there to be economic prosperity and we can work together, and of course we'll be talking about security. And your words have been very strong about Pakistan's sovereign right and sovereign duty to protect your country, and the United States wants to help," Bush said.

Bailouts will lead to rough economic ride

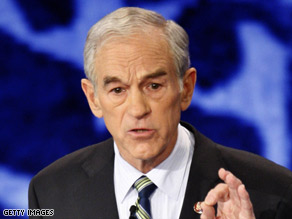

By Ron PaulEditor's note: Ron Paul is a Republican congressman from Texas who ran for his party's nomination for president this year. He is a doctor who specializes in obstetrics/gynecology and says he has delivered more than 4,000 babies. He served in Congress in the late 1970s and early 1980s and was elected again to Congress in 1996. Rep. Paul serves on the House Financial Services Committee.

Rep. Ron Paul says the government's solution to the crisis is the same as the cause of it -- too much government.

(CNN) -- Many Americans today are asking themselves how the economy got to be in such a bad spot.

For years they thought the economy was booming, growth was up, job numbers and productivity were increasing. Yet now we find ourselves in what is shaping up to be one of the most severe economic downturns since the Great Depression.

Unfortunately, the government's preferred solution to the crisis is the very thing that got us into this mess in the first place: government intervention.

Ever since the 1930s, the federal government has involved itself deeply in housing policy and developed numerous programs to encourage homebuilding and homeownership.

Government-sponsored enterprises Fannie Mae and Freddie Mac were able to obtain a monopoly position in the mortgage market, especially the mortgage-backed securities market, because of the advantages bestowed upon them by the federal government.

Laws passed by Congress such as the Community Reinvestment Act required banks to make loans to previously underserved segments of their communities, thus forcing banks to lend to people who normally would be rejected as bad credit risks.

These governmental measures, combined with the Federal Reserve's loose monetary policy, led to an unsustainable housing boom. The key measure by which the Fed caused this boom was through the manipulation of interest rates, and the open market operations that accompany this lowering.

When interest rates are lowered to below what the market rate would normally be, as the Federal Reserve has done numerous times throughout this decade, it becomes much cheaper to borrow money. Longer-term and more capital-intensive projects, projects that would be unprofitable at a high interest rate, suddenly become profitable.

Because the boom comes about from an increase in the supply of money and not from demand from consumers, the result is malinvestment, a misallocation of resources into sectors in which there is insufficient demand.

In this case, this manifested itself in overbuilding in real estate. When builders realize they have overbuilt and have too many houses to sell, too many apartments to rent, or too much commercial real estate to lease, they seek to recoup as much of their money as possible, even if it means lowering prices drastically.

This lowering of prices brings the economy back into balance, equalizing supply and demand. This economic adjustment means, however that there are some winners -- in this case, those who can again find affordable housing without the need for creative mortgage products, and some losers -- builders and other sectors connected to real estate that suffer setbacks.

The government doesn't like this, however, and undertakes measures to keep prices artificially inflated. This was why the Great Depression was as long and drawn out in this country as it was.

I am afraid that policymakers today have not learned the lesson that prices must adjust to economic reality. The bailout of Fannie and Freddie, the purchase of AIG, and the latest multi-hundred billion dollar Treasury scheme all have one thing in common: They seek to prevent the liquidation of bad debt and worthless assets at market prices, and instead try to prop up those markets and keep those assets trading at prices far in excess of what any buyer would be willing to pay.

Additionally, the government's actions encourage moral hazard of the worst sort. Now that the precedent has been set, the likelihood of financial institutions to engage in riskier investment schemes is increased, because they now know that an investment position so overextended as to threaten the stability of the financial system will result in a government bailout and purchase of worthless, illiquid assets.

Using trillions of dollars of taxpayer money to purchase illusory short-term security, the government is actually ensuring even greater instability in the financial system in the long term.

The solution to the problem is to end government meddling in the market. Government intervention leads to distortions in the market, and government reacts to each distortion by enacting new laws and regulations, which create their own distortions, and so on ad infinitum.

It is time this process is put to an end. But the government cannot just sit back idly and let the bust occur. It must actively roll back stifling laws and regulations that allowed the boom to form in the first place.

The government must divorce itself of the albatross of Fannie and Freddie, balance and drastically decrease the size of the federal budget, and reduce onerous regulations on banks and credit unions that lead to structural rigidity in the financial sector.

Until the big-government apologists realize the error of their ways, and until vocal free-market advocates act in a manner which buttresses their rhetoric, I am afraid we are headed for a rough ride.

'Crony' Capitalism Is Root Cause Of Fannie And Freddie Troubles

By TERRY JONES

In the past couple of weeks, as the financial crisis has intensified, a new talking point has emerged from the Democrats in Congress: This is all a "crisis of capitalism," in socialist financier George Soros' phrase, and a failure to regulate our markets sufficiently.

Well, those critics may be right — it is a crisis of capitalism. A crisis of politically driven crony capitalism, to be precise.

Indeed, Democrats have so effectively mastered crony capitalism as a governing strategy that they've convinced many in the media and the public that they had nothing whatsoever to do with our current financial woes.

Barack Obama has repeatedly blasted "Bush-McCain" economic policies as the cause, as if the two were joined at the hip.

Funny, because over the past 8 years, those who tried to fix Fannie Mae and Freddie Mac — the trigger for today's widespread global financial meltdown — were stymied repeatedly by congressional Democrats.

This wasn't an accident. Though some key Republicans deserve blame as well, it was a concerted Democratic effort that made reform of Fannie and Freddie impossible.

The reason for this is simple: Fannie and Freddie became massive providers both of reliable votes among grateful low-income homeowners, and of massive giving to the Democratic Party by grateful investment bankers, both at the two government-sponsored enterprises and on Wall Street.

The result: A huge taxpayer rescue that at last estimate is approaching $700 billion but may go even higher.

It all started, innocently enough, in 1994 with President Clinton's rewrite of the Carter-era Community Reinvestment Act.

Ostensibly intended to help deserving minority families afford homes — a noble idea — it instead led to a reckless surge in mortgage lending that has pushed our financial system to the brink of chaos.

Subprime's Mentors

Fannie and Freddie, the main vehicle for Clinton's multicultural housing policy, drove the explosion of the subprime housing market by buying up literally hundreds of billions of dollars in substandard loans — funding loans that ordinarily wouldn't have been made based on such time-honored notions as putting money down, having sufficient income, and maintaining a payment record indicating creditworthiness.

With all the old rules out the window, Fannie and Freddie gobbled up the market. Using extraordinary leverage, they eventually controlled 90% of the secondary market mortgages. Their total portfolio of loans topped $5.4 trillion — half of all U.S. mortgage lending. They borrowed $1.5 trillion from U.S. capital markets with — wink, wink — an "implicit" government guarantee of the debts.

This created the problem we are having today.

As we noted a week ago, subprime lending surged from around $35 billion in 1994 to nearly $1 trillion last year — for total growth of 2,757% as of last year.

No real market grows that fast for that long without being fixed.

And that's just what Fannie and Freddie were — fixed. They became a government-run, privately owned home finance monopoly.

Fannie and Freddie became huge contributors to Congress, spending millions to influence votes. As we've noted here before, the bulk of the money went to Democrats.

Dollars To Dems

Meanwhile, Fannie and Freddie also became a kind of jobs program for out-of-work Democrats.

Franklin Raines and Jim Johnson, the CEOs under whom the worst excesses took place in the late 1990s to mid-2000s, were both high-placed Democratic operatives and advisers to presidential candidate Barack Obama.

Clinton administration official Jamie Gorelick also got taken care of by the Fannie-Freddie circle. So did top Clinton aide Rahm Emanuel, among others.

On the surface, this sounds innocent. Someone has to head the highly political Fannie and Freddie, right?

But this is why crony capitalism is so dangerous. Those in power at Fannie and Freddie, as the sirens began to wail about some of their more egregious practices, began to bully those who opposed them.

That included journalists, like the Wall Street Journal's Paul Gigot, and GOP congressmen, like Wisconsin Rep. Paul Ryan, whom Fannie and Freddie actively lobbied against in his own district. Rep. Cliff Stearns, R-Fla., who tried to hold hearings on Fannie's and Freddie's questionable accounting practices in 2004, found himself stripped of responsibility for their oversight by House Speaker Dennis Hastert — a Republican.

Where, you ask, were the regulators?

Congress created a weak regulator to oversee Freddie and Fannie — the Office of Federal Housing Enterprise Oversight — which had to go hat in hand each year to Capitol Hill for its budget, unlike other major regulators.

With lax oversight, Fannie and Freddie had a green light to expand their operations at breakneck speed.

Fannie and Freddie had a reliable coterie of supporters in the Senate, especially among Democrats.

"We now know that many of the senators who protected Fannie and Freddie, including Barack Obama, Hillary Clinton and Christopher Dodd, have received mind-boggling levels of financial support from them over the years," wrote economist Kevin Hassett on Bloomberg.com this week.

Buying Friends In High Places

Over the span of his career, Obama ranks No. 2 in campaign donations from Fannie and Freddie, taking over $125,000. Dodd, head of the Senate Banking panel, is tops at $165,000. Clinton, ranked 12th, has collected $75,000.

Meanwhile, Freddie and Fannie opened what were euphemistically called "Partnership Offices" in the districts of key members of Congress to channel millions of dollars in funding and patronage to their supporters.

In the space of a little more than a decade, Fannie and Freddie spent close to $150 million on lobbying efforts. So pervasive were their efforts, they seemed unassailable, even during a Republican administration.

Yet, by 2004, the crony capitalism had gone too far. Even OFHEO issued a report essentially criticizing Fannie and Freddie for Enron-style accounting that let them boost profits in order to pay their politically well-connected executives hefty bonuses.

It emerged that Clinton aide Raines, who took Fannie Mae's helm as CEO in 1999, took in nearly $100 million by the time he left in 2005. Others, including former Clinton Justice Department official Gorelick, took $75 million from the Fannie-Freddie piggy bank.

Even so, Fannie and Freddie were forced to restate their earnings by some $3.5 billion, due to the accounting shenanigans.

As we noted, those who tried to halt this frenzy of activity found themselves hit by a political buzz saw.

President Bush, reviled and criticized by Democrats, tried no fewer than 17 times, by White House count, to raise the issue of Fannie-Freddie reform. A bill cleared the Senate Banking panel in 2005, but stalled due to implacable opposition from Democrats and a critical core of GOP abettors. Rep. Barney Frank, who now runs the powerful House Financial Services Committee, helped spearhead that fight.

Now, with the taxpayer tab approaching $1 trillion or more, we're learning the costs of crony capitalism.

In the coming days, an IBD series will look into this phenomenon in greater detail — how we got here, who's responsible, and why nothing was done.

![[Hugo Chavez]](http://s.wsj.net/public/resources/images/HC-GC071A_Chave_20060529150430.gif)

No hay comentarios.:

Publicar un comentario