El orden espontáneo

El orden espontáneo

El País, Madrid

El Negro Cucaracha fue uno de los capos

indiscutidos de una de las cárceles de Lima durante muchos años y, me

dicen, tiene el cuerpo hecho un crucigrama de cicatrices de tanta

cuchillada que recibió en esos tiempos turbulentos. Es un moreno alto,

fornido y de edad indefinible a cuyo paso la gente de Gamarra se abre

como ante un río incontenible. Me lo han puesto de guardaespaldas y no

sé por qué pues en este rincón de La Victoria me siento más seguro que

en el barrio donde vivo, Barranco, donde no son infrecuentes los atracos

con pistola.

El Negro Cucaracha es ahora un hombre

religioso y pacífico. Se ha vuelto evangélico, anda con una biblia en la

mano y en el largo paseo me recita versículos sagrados y me habla de

redención, arrepentimiento y salvación con esa seguridad del creyente

radical que a mí siempre me pone algo nervioso.

El idilio de Maduro con Asad

El idilio de Maduro con Asad

Por Andrés Oppenheimer

Gran parte del mundo está exigiendo que se ejerza

mayor presión sobre Siria tras el informe de los inspectores de las

Naciones Unidas según el cual se utilizaron armas químicas en Siria,

pero —sorprendentemente— Venezuela y algunos de sus aliados siguen

defendiendo apasionadamente al dictador sirio Bashar al Assad.

A

principios de esta semana, después de que el Secretario General de las

Naciones Unidas Ban Ki-moon presentó el informe de los inspectores de la

ONU según el cual existen “evidencias claras y convincentes” de que se

usaron armas químicas en el ataque del 21 de agosto en los suburbios de

Damasco, el presidente venezolano Nicolás Maduro atacó al encargado de

la ONU por supuestamente apoyar a los enemigos del “pueblo sirio”.

La caza del dólar en Venezuela

Dos venezolanos en una calle de Caracas. / JUAN BARRETO (AFP)

El billete verde es el bien más preciado en el país, pero sólo los elegidos, o los que puedan pagar su alto costo en el mercado negro, pueden tenerlo

Mientras el desabastecimiento y el malestar entre los venezolanos por la recurrente falta de alimentos básicos se acrecienta,

el Gobierno de Nicolás Maduro intenta aliviar las causas que originaron

esta situación, derivadas del sistema de controles a la economía

impuesto por su antecesor Hugo Chávez hace una década. Pero el Gobierno

se enfrenta a un problema. No tiene dólares oficiales para satisfacer la

demanda de productores y comerciantes.

EE UU y México basan en la integración económica la renovación de su alianza

El vicepresidente Joe Biden y el presidente Enrique Peña Nieto. / ALFREDO ESTRELLA (AFP)

Biden califica de “necesarias” las reformas de Peña Nieto y pide “valor político” para potenciar las relaciones entre los dos países

El vicepresidente de Estados Unidos, Joe Biden, y el presidente de

México, Enrique Peña Nieto, ratificaron este viernes la renovación de la

alianza estratégica entre los dos países basada en una visión

compartida: hacer de Norteamérica el motor de la economía global en el

siglo XXI, a partir de la coincidencia de intereses y la integración

comercial. “No hay relación más importante para EE UU ni ningún otro

socio con mayor potencial de crecimiento ni una alianza más importante

que la que tenemos con México”, declaró Biden, quien recordó que en 2014

se cumplen 20 años del Tratado de Libre Comercio.

Peña Nieto, por su parte, destacó el clima de “respeto y confianza” de

una relación, que ya no está monopolizada como en los últimos años por

el problema de la seguridad.

El argumento económico, y demográfico, para una reforma inmigratoria

SOL TRUJILLO Y CÉSAR M. MELGOZA

Desde la elección [presidencial] de noviembre, se escucha mucho en Washington y dentro del circuito de expertos, comentarios sobre la cambiante cara de Estados Unidos, especialmente el "voto latino" y la nueva realidad de hacer campaña política. También ha habido discusiones considerables sobre inmigración y lo que significa para un país que es una nación de inmigrantes pero que está más poblado que antes.El debate sobre inmigración es significativo para la política y cultura estadounidenses, pero también es crucial para la economía del país, un tema que recibe poca atención. Seamos francos: la fortuna y bienestar de los estadounidenses —es decir, la seguridad económica, la seguridad nacional, la innovación empresarial, el crecimiento del PIB y el estatus en el mercado global—, requieren una solución exhaustiva a los problemas crónicos causados por una política migratoria deficiente. En particular, el estatus de 11 millones de inmigrantes latinoamericanos indocumentados que viven en EE.UU. debe ser resuelto.

La economía es sencilla: los latinos generan demanda. Setenta por ciento del Producto Interno Bruto del país es alimentado por el consumo. Eso significa que la población latina, grande, en expansión y cada vez más próspera, jugará un papel clave en el futuro económico de EE.UU.

Kirchner busca la ruina financiera de la prensa independiente

El gobierno argentino hace uso de inspectores tributarios y boicots publicitarios para castigar a sus detractores

La presidenta argentina, Cristina Fernández de Kirchner, considera que los adolescentes de 16 años deben votar y en octubre sus aliados en el Congreso redujeron la edad mínima para votar de 18 a 16 años para que lo puedan hacer. El objetivo, en palabras de una kirchnerista, es "ampliar la base electoral de nuestra democracia".Se estima que un millón de argentinos son parte de este nuevo electorado. La mayoría de ellos tiene poca experiencia ganándose la vida. Eso los convierte en el blanco demográfico perfecto para el partido de la presidenta a medida que la economía se viene abajo antes de las elecciones legislativas programadas para octubre.

De todos modos, a la hora de inclinar la balanza a su favor, la presidenta no está dejando el resultado en manos de un grupo de chicos. Ha seguido el ejemplo de Hugo Chávez y busca llevar a la quiebra a los medios libres e independientes cortando su acceso a la publicidad.

Es hora de fijar límites a los bancos

¿Ser o no ser un banco?

La Reserva Federal de Estados Unidos, el Congreso y algunas de las mayores instituciones financieras del mundo están por abordar la pregunta existencial de qué es un banco.

La versión más acotada del debate es si debería mantenerse la situación actual en la que J.P. Morgan Chase JPM +0.09% & Co., Goldman Sachs Group Inc. GS +1.17% y Morgan Stanley MS -1.43% deberían seguir siendo dueños, almacenadores y transportadores de commodities como petróleo, cobre y electricidad. Pero sus ramificaciones llegan a un pilar de la arquitectura financiera moderna en EE.UU.: la separación de finanzas y comercio.

Las decisiones que se tomen en las próximas semanas deberían determinar los límites de lo que pueden y no pueden hacer los bancos. También afectarán a otros participantes de la economía, desde cerveceras hasta quienes toman Coca-Cola KO +0.23% .

La Reserva Federal de Estados Unidos, el Congreso y algunas de las mayores instituciones financieras del mundo están por abordar la pregunta existencial de qué es un banco.

La versión más acotada del debate es si debería mantenerse la situación actual en la que J.P. Morgan Chase JPM +0.09% & Co., Goldman Sachs Group Inc. GS +1.17% y Morgan Stanley MS -1.43% deberían seguir siendo dueños, almacenadores y transportadores de commodities como petróleo, cobre y electricidad. Pero sus ramificaciones llegan a un pilar de la arquitectura financiera moderna en EE.UU.: la separación de finanzas y comercio.

Las decisiones que se tomen en las próximas semanas deberían determinar los límites de lo que pueden y no pueden hacer los bancos. También afectarán a otros participantes de la economía, desde cerveceras hasta quienes toman Coca-Cola KO +0.23% .

Obama, neocón a su pesar

GEES

Aunque la motivación de Obama es responsabilizar a otros de lo que le incumbe, quizá sea mejor, aunque no necesario, que la autorización para usar la fuerza proceda de Capitol Hill.

Legalicemos todas las drogas

John Stossel

Todo esto está relacionado con mi asistencia a un acto organizado por el Marijuana Policy Project

para celebrar la aprobación, por parte del Legislativo del estado de

Nueva York, de una ley –que aún no ha recibido el visto bueno del Senado

local– por la que se autoriza el uso de la marihuana con fines

terapéuticos. Cuando me dirigí a los allí presentes, dije que resultaba

patético que se considerara digno de celebración el hecho de que una

propuesta de este tipo haya conseguido llegar al Senado. Claro que el

uso terapéutico de la marihuana debería ser legal. De hecho, para los

adultos todo debería ser legal.

Las mentiras de Washington

Impuestos

Walter Williams

El

Comité de Asignaciones de la Cámara, junto al entonces presidente

Johnson, estimó que el Medicare costaría unos 12.000 millones de dólares

ajustados por la inflación hacia 1990. Ese año, el Medicare superaba la

cota de los 107.000 millones de dólares.

El

Comité de Asignaciones de la Cámara, junto al entonces presidente

Johnson, estimó que el Medicare costaría unos 12.000 millones de dólares

ajustados por la inflación hacia 1990. Ese año, el Medicare superaba la

cota de los 107.000 millones de dólares.

Four Reasons Not To Worry About The Fed’s Taper

By Alan Reynolds

At Wednesday’s Federal Reserve announcement, policymakers are widely

expected to begin to scale back (taper) monthly purchases of Treasury

and agency bonds from $85 billion to perhaps $70 billion or so.

Such a change would be minuscule compared to the huge stock of outstanding Treasury and agency bonds or to daily trading volume. Yet many analysts fear that even so trivial a change must be ominous for stockholders, even though the Fed pledges to keep short-term rates near zero.

As one financial columnist recently put it, “worries focus on what will happen to stocks as that stimulus begins to shrink.”

Such a change would be minuscule compared to the huge stock of outstanding Treasury and agency bonds or to daily trading volume. Yet many analysts fear that even so trivial a change must be ominous for stockholders, even though the Fed pledges to keep short-term rates near zero.

As one financial columnist recently put it, “worries focus on what will happen to stocks as that stimulus begins to shrink.”

¿Cómo alcanzó el mexicano Carlos Slim el éxito empresarial?

El Economista America -

El empresario mexicano de ascendencia libanesa Carlos Slim en una imagen de archivo.|EFE

El empresario mexicano de ascendencia libanesa Carlos Slim en una imagen de archivo.|EFEA mediados de los 80, cimentó un imperio a base de grandes inversiones y con la adquisición de varias empresas. Slim siempre lo tuvo claro: "Si mi padre, en plena Revolución, con el país sacudido, sin todavía tener familia, siendo extranjero y sin el arraigo que te da el tiempo, confió en México y en su futuro, cómo no iba a hacerlo yo". ¿Por qué América Móvil saldrá bien librada con KPN?

Grandes fortunas y desigualdad; los multimillonarios de América Latina proceden de los países menos igualitarios

El Economista America -

El magnate mexicano Carlos Slim durante una conferencia en Cartagena (Colombia).|EFE

El magnate mexicano Carlos Slim durante una conferencia en Cartagena (Colombia).|EFEEntre los sectores más favorables para los negocios en América Latina siguen encontrándose la minería, petróleo, medios de comunicación y la banca. Paradójicamente, los nuevos multimillonarios provienen de los países con más desigualdades en la redistribución de ingresos.

¿En qué fase están las bolsas?

elEconomista

EE.UU. exagera la amenaza de Al Qaeda

por John Mueller

John H. Mueller es catedrático de Ciencia Política en la Universidad de Ohio.

En una entrevista reciente, el jefe de Seguridad Interior de Estados Unidos, proclamó que la "lucha" contra el terrorismo es una lucha "existencial importante", con cuidado de diferenciarla, por lo visto, de todas esas otras luchas existenciales insignificantes que hemos librado en el pasado.

Mientras tanto, The New York Times asegura que "la lucha contra Al Qaeda es la batalla fundamental de esta generación", y John McCain amplía el concepto y la llama "el reto trascendental del siglo XXI", mientras que los demócratas insisten sin cesar en que la guerra de Irak ha reforzado y vuelto más compleja la amenaza terrorista.

John H. Mueller es catedrático de Ciencia Política en la Universidad de Ohio.

En una entrevista reciente, el jefe de Seguridad Interior de Estados Unidos, proclamó que la "lucha" contra el terrorismo es una lucha "existencial importante", con cuidado de diferenciarla, por lo visto, de todas esas otras luchas existenciales insignificantes que hemos librado en el pasado.

Mientras tanto, The New York Times asegura que "la lucha contra Al Qaeda es la batalla fundamental de esta generación", y John McCain amplía el concepto y la llama "el reto trascendental del siglo XXI", mientras que los demócratas insisten sin cesar en que la guerra de Irak ha reforzado y vuelto más compleja la amenaza terrorista.

EE.UU.: Nuestra burocrática guerra contra el terrorismo

por Gene Healy

Adivine qué sucede cuando se combina un ambiente de crisis con una abundancia de fondos federales. Se obtiene una peligrosa burocracia devoradora de recursos que fracasa en alcanzar su aparente objetivo, ya sea una mejor atención médica, combatir el abuso de las drogas o descubrir amenazas terroristas.

Esa es la lección de “Top Secret America”, la sonada serie de artículos en el Washington Post sobre el complejo industrial y de inteligencia post 11 de septiembre. Uno pensaría que una clásica historia de extralimitación e incompetencia estatal tendría eco entre los conservadores, pero su reacción ha sido en gran parte silenciosa y de poco interés. A pesar de que los conservadores generalmente aprecian la visión libertaria sobre la tendencia de las burocracias a auto-preservarse y a ser capturada por intereses especiales y abusar del poder, se hacen de la vista gorda cuando se trata de seguridad nacional.

Adivine qué sucede cuando se combina un ambiente de crisis con una abundancia de fondos federales. Se obtiene una peligrosa burocracia devoradora de recursos que fracasa en alcanzar su aparente objetivo, ya sea una mejor atención médica, combatir el abuso de las drogas o descubrir amenazas terroristas.

Esa es la lección de “Top Secret America”, la sonada serie de artículos en el Washington Post sobre el complejo industrial y de inteligencia post 11 de septiembre. Uno pensaría que una clásica historia de extralimitación e incompetencia estatal tendría eco entre los conservadores, pero su reacción ha sido en gran parte silenciosa y de poco interés. A pesar de que los conservadores generalmente aprecian la visión libertaria sobre la tendencia de las burocracias a auto-preservarse y a ser capturada por intereses especiales y abusar del poder, se hacen de la vista gorda cuando se trata de seguridad nacional.

Cuando caen los tiranos pro-EE.UU.

por Ted Galen Carpenter

Ted Galen Carpenter

es vicepresidente de Estudios de Defensa y Política Exterior del Cato

Institute y autor o editor de varios libros sobre asuntos

internacionales, incluyendo Bad Neighbor Policy: Washington's Futile War on Drugs in Latin America (Cato Institute, 2002).

Ted Galen Carpenter

es vicepresidente de Estudios de Defensa y Política Exterior del Cato

Institute y autor o editor de varios libros sobre asuntos

internacionales, incluyendo Bad Neighbor Policy: Washington's Futile War on Drugs in Latin America (Cato Institute, 2002).

Mientras que el régimen del presidente egipcio Hosni Mubarak pende de

un hilo, la especulación en Washington acerca de qué podría venir

después cambia casi a diario. “Solamente él sabe lo que va a hacer”,

dijo Barack Obama acerca de Mubarak el domingo.

Ted Galen Carpenter

es vicepresidente de Estudios de Defensa y Política Exterior del Cato

Institute y autor o editor de varios libros sobre asuntos

internacionales, incluyendo Bad Neighbor Policy: Washington's Futile War on Drugs in Latin America (Cato Institute, 2002).

Ted Galen Carpenter

es vicepresidente de Estudios de Defensa y Política Exterior del Cato

Institute y autor o editor de varios libros sobre asuntos

internacionales, incluyendo Bad Neighbor Policy: Washington's Futile War on Drugs in Latin America (Cato Institute, 2002).Por qué EE.UU. sería arrastrado a una guerra si Israel ataca a Irán

por Malou Innocent y Ehud Eilam

Malou Innocent es analista de política exterior del Cato Institute.

Ehud Eilam trabajó en el Ministerio de Defensa de Israel y se especializa en el Oriente Medio y en la doctrina militar israelita.

El Primer Ministro israelí Benjamin Netanyahu ha dicho que Hezbollah —la organización político-terrorista basada en Líbano, respaldada por Irán— fue responsable del bombardeo suicida en Bulgaria que mató a cinco turistas israelitas. En medio de las continuas amenazas por parte de EE.UU. e Israel de atacar las instalaciones nucleares de Irán, el bombardeo provoca una preocupación crítica acerca del potencial conflicto: una Hezbollah muy capacitada, junto con Irán, probablemente atacaría en represalia —y no solamente en Oriente Medio— arrastrando a EE.UU. hacia otro sangriento conflicto de larga duración en el mundo musulmán, algo que no necesita. Ese escenario debería hacer que aquellos que proponen una guerra con Irán lo reconsideren.

Malou Innocent es analista de política exterior del Cato Institute.

Ehud Eilam trabajó en el Ministerio de Defensa de Israel y se especializa en el Oriente Medio y en la doctrina militar israelita.

El Primer Ministro israelí Benjamin Netanyahu ha dicho que Hezbollah —la organización político-terrorista basada en Líbano, respaldada por Irán— fue responsable del bombardeo suicida en Bulgaria que mató a cinco turistas israelitas. En medio de las continuas amenazas por parte de EE.UU. e Israel de atacar las instalaciones nucleares de Irán, el bombardeo provoca una preocupación crítica acerca del potencial conflicto: una Hezbollah muy capacitada, junto con Irán, probablemente atacaría en represalia —y no solamente en Oriente Medio— arrastrando a EE.UU. hacia otro sangriento conflicto de larga duración en el mundo musulmán, algo que no necesita. Ese escenario debería hacer que aquellos que proponen una guerra con Irán lo reconsideren.

Sobre el fracaso de la sanciones económicas en Irán

por Steve H. Hanke

Steve H. Hanke es profesor de economía aplicada en la Universidad Johns Hopkins y Senior Fellow del Cato Institute.

Steve H. Hanke es profesor de economía aplicada en la Universidad Johns Hopkins y Senior Fellow del Cato Institute.

Cuando el presidente Obama nominó al senador Chuck Hagel para Secretario de Defensa de EE.UU., el asunto de Irán —y las sanciones económicas,

en particular— volvió a la palestra. Hagel ha sido vapuleado por los

neoconservadores y algunos partidarios firmes de Israel por atreverse a

cuestionar (en el pasado) que las sanciones son la mejor manera de

confrontar las ambiciones nucleares de Irán. Resulta que las sanciones

han fracasado en obligar a Teherán a abandonar su programa nuclear. De hecho, las sanciones tienen una larga historia de fracaso.

Steve H. Hanke es profesor de economía aplicada en la Universidad Johns Hopkins y Senior Fellow del Cato Institute.

Steve H. Hanke es profesor de economía aplicada en la Universidad Johns Hopkins y Senior Fellow del Cato Institute.¿QUIENES SON LOS GARZA LAGUERA?

Este jueves la conocida familia regiomontana

protagonizó las noticias debido al pleito familiar entre los hermanos

Javier y Ricardo que dejó al primero en el hospital.

|

| Eugenio Garza Sada murió el 17 de septiembre de 1973 a los 81 años luego de un intento de secuestro que terminó en balacera cuando el empresario intentó defenderse. A su funeral asisitieron más de 50 mil personas, entre ellas el presidente de México en aquél entonces, Luis Echeverría. (Foto: Especial) |

Los hermanos Javier y Ricardo Garza Lagüera, quienes este jueves 24 de enero protagonizaron una disputa familiar que terminó con uno de ellos herido de bala, pertenecen a la importante familia regiomontana del fallecido Eugenio Garza Sada, fundador de FEMSA y el Instituto Tecnológico de Estudios Superiores de Monterrey (ITESM).

El patriarca de la familia, Eugenio Garza Sada, es originario de Monterrey, Nuevo León. Tras graduarse de Ingeniero Civil en el MIT comenzó a trabajar en Cervecería Cuauhtémoc, fundada por su padre Isaac Garza Garza en 1890, como auxiliar del departamento de estadística y luego comenzó a ocupar cargos más importantes. Fue a la muerte de su padre en 1933 cuando pasó a formar parte del Consejo de Administración de la empresa.

De su matrimonio con Consuelo Lagüera Zambrano tuvo ocho hijos: Eugenio, Alejandro, Alicia, Consuelo, Gabriel, Marcelo, David y Manuel.

Javier y Ricardo, los hermanos en discordia, son hijos del sexto hijo de la pareja, Marcelo Garza Lagüera, quien falleció el 30 de julio de 2008 en Monterrey a los 74 años de edad luego de una larga enfermedad, fue presidente y director general de Grupo Orión, compañía de pisos y utensilios de cerámica que fundó su padre Eugenio Garza Sada.

|

| Eugenio Garza Lagüera murió el 24 de mayo de 2008 a los 85 años por causas naturales. A su funeral acudieron industriales, empresarios y políticos, entre ellos el ex presidente de México, Felipe Calderón y su esposa Margarita Zavala. (Foto: Especial) |

|

De acuerdo con CNN Expansión, algunos piensan que si Eugenio Garza Lagüera, miembro fundador de grupo FEMSA, no hubiera muerto, la reciente polémica venta de Cervecería Cuauhtémoc a Heineken, no se habría realizado.

Don Marcelo también tuvo un papel relevante en la Sociedad Cuauhtémoc y Famosa, organización cultural y de recreación de Grupo Visa, hoy Fomento Económico Mexicano (FEMSA), sin embargo dejó de ser parte del grupo desde hace varios años y en el año 2000 se mudó a Irapuato, Guanajuato, donde fundó el periódico Guanajuato Hoy; su actividad periodística la combinó con el negocio de productos sanitarios y válvulas Orión.

Javier y Ricardo heredaron los negocios de su padre junto con sus otros cuatro hermanos: Marcelo, Gerardo, Lucía y Catalina.

Según información de la periodista Carmen Aristegui, en la discusión de este jueves entre los hermanos, también está involucrado el empresario relacionado con cultivos transgénicos, Alfonso Romo Garza, actual CEO de Grupo Plenus.

Romo es además un filántropo; entre las organizaciones que apoya está la Fundación EducarUno, creada por él y dirigida por su hijo, Alfonso Romo Garza Lagüera.

Argentina: “Después de mi, el diluvio” – por Malú Kikuchi

Argentina: “Después de mi, el diluvio” – por Malú Kikuchi

Y

pasaron las PASO. Al pasar dejaron en claro que el mítico 54% de

octubre 2011 en apoyo a Cristina, se había minimizado a un escuálido

26%. Nunca se vio tanta velocidad en la caída. Es para el Guiness. En 22

meses rifó, dilapidó, 4 millones de votos. ¡Qué éxito para el fracaso!

Y

pasaron las PASO. Al pasar dejaron en claro que el mítico 54% de

octubre 2011 en apoyo a Cristina, se había minimizado a un escuálido

26%. Nunca se vio tanta velocidad en la caída. Es para el Guiness. En 22

meses rifó, dilapidó, 4 millones de votos. ¡Qué éxito para el fracaso!A pesar de lo cual, Cristina decidió no darse por enterada. Ella no perdió las PASO, si es que se perdieron, es responsabilidad de Scioli, Insaurralde, Moreno, Kicillof o el quiosquero de la esquina. Además, las PASO no son elecciones, cuanto mucho una encuesta general, que se puede revertir.

Argentina: El joven Frankenstein – por Anton Barreneche

Argentina: El joven Frankenstein – por Anton Barreneche

La

genial obra de Mel Brooks nos muestra la arrogancia de un científico al

dar vida a materia inanimada. Todo sale mal y su creación no pasa de un

dislate con el cerebro equivocado. Cuando ve su creación… a pesar de la

alegría y el cariño que despierta ese monstruo, le invade una

melancolía por el error cometido.

La

genial obra de Mel Brooks nos muestra la arrogancia de un científico al

dar vida a materia inanimada. Todo sale mal y su creación no pasa de un

dislate con el cerebro equivocado. Cuando ve su creación… a pesar de la

alegría y el cariño que despierta ese monstruo, le invade una

melancolía por el error cometido.Maduro se va a China y Cabello asegura que no habrá golpe de Estado en su ausencia

Internacional

El presidente de la Asamblea Nacional concede el permiso al presidente venezolano para su visita de doce días al país asiático

El presidente de la Asamblea Nacional, Diosdado Cabello, aprobó el permiso del presidente venezolano Nicolás Maduro

para que viaje a China el próximo 21 para una larga visita de unos 12

días, asegurando que puede viajar tranquilo que durante su ausencia no

habrá golpe de Estado.

EE.UU. autoriza a última hora que el avión de Maduro sobrevuele Puerto Rico en su viaje a China

Internacional

- Washington (lugares)

- Puerto Rico (lugares)

- Venezuela (lugares)

- Pekin (lugares)

Según Washington, la solicitud no había sido cursada adecuadamente

Estados Unidos aprobó en el último minuto el plan de vuelo del presidente venezolano, Nicolás Maduro, para permitirle sobrevolar Puerto Rico en su viaje hacia China, según ha informado este viernes el Departamento de Estado.

«He matado a 300 personas», confiesa el único sicario vivo de Pablo Escobar

Internacional / colombia

Jhon Jairo Velásquez Vásquez, alias «Popeye», añade que «participó y coordinó alrededor de 3.000 muertes»

El anuncio escalofrió. Después de estar preso durante veintitrés años en una de las cárceles de mayor seguridad en Colombia, la revista «Semana», la de mayor circulación en el país, anunciaba la libertad inminente de quien fuera el principal sicario del narcotraficante Pablo Escobar Gaviria, Jhon Jairo Velásquez Vásquez, alias «Popeye».

La publicación lo entrevistó a destajo y las respuestas del

sicario pusieron a temblar a los colombianos. A la pregunta de cuántas

personas había matado, dijo: «Yo personalmente creo que alrededor de 300. Pero he participado y coordinado alrededor de 3.000 muertes», contó.

Don Eugenio

Don Eugenio

A

don Eugenio ningún presidente lo hubiera chamaqueado con la promesa de

convertirlo en uno de los nuevos potentados de la reforma energética, a cambio

de su apoyo incondicional o de su silencio.

Siempre admiré el espíritu emprendedor,

creativo, tesonero y con sentido social de don Eugenio Garza Sada.

Lo conocí a principios de los 70,

cuando acudí a su despacho para solicitarle una beca para estudiar en el

Tecnológico de Monterrey.

Me sorprendió su humildad, su fácil

acceso, su capacidad de analizar el árbol sin perderse en el bosque. Pero

sobre todo la dignidad con la que se defendía frente al creciente

estatismo.

Fue asesinado hace 40 años por un

comando de izquierda que lo intentaba secuestrar. Y su muerte fue muy oportuna

y conveniente para quien entonces vivía en Los Pinos.

La Unión de Padres de Familia

La Unión de Padres de Familia

Los

maestros, algunos vándalos y otros bárbaros, además de otras fuerzas oscuras

integradas por golpeadores profesionales financiados por intereses

inconfesables —que bien debe conocer la Secretaría de Gobernación— toman las

calles de la Ciudad de México y al hacerlo dejan a millones de niños que quedan

desamparados a una suerte en la que tampoco repara la Unión de Padres de

Familia.

¿Resultado? Nuestros hijos, la gran

esperanza del futuro de México y bla, bla y bla… —meros discursos políticos

para emocionar al populacho— se quedan sin escuelas al encontrarlas

clausuradas, salvo que hayan logrado entrar a los salones de clase para verlos

vacíos porque los “forjadores de la nación” estaban recibiendo un tamal, un

vaso con atole y una naranja a cientos de kilómetros de distancia para

protestar en contra de su capacitación profesional, es decir, de la evolución y

del progreso de la patria.

Reforma energética, ¿el parto de los montes?

|

Reforma energética, ¿el parto de los montes?

Pablo

Hiriart

|

|

|

|

Malas noticias para la reforma energética: el

Senado va a abrir un foro de consultas sobre la materia, como si el tema no

estuviera suficientemente discutido.

Cuando se quiere dar el gusto a todos no se logra lo óptimo, sino lo que el consenso permite. En el sexenio anterior ya estaban acordadas, entre PAN y PRI, las líneas generales de lo que sería la reforma en la materia, pero una súbita e inopinada decisión del entonces líder panista en el Senado abrió la discusión a un foro abierto que acabó por descafeinar la iniciativa. |

Venezuela: Nicolás Maduro culpa al Hombre Araña por violencia – ABC

Venezuela: Nicolás Maduro culpa al Hombre Araña por violencia – ABC

“Ese

muchacho que a los 14 años carga una (arma) 9 milímetros tiene en el

cerebro miles de horas de transmisión de series donde matan gente”, dijo

Maduro al anunciar apoyos económicos al Sistema de Orquestas Juveniles e

Infantiles.

“Ese

muchacho que a los 14 años carga una (arma) 9 milímetros tiene en el

cerebro miles de horas de transmisión de series donde matan gente”, dijo

Maduro al anunciar apoyos económicos al Sistema de Orquestas Juveniles e

Infantiles.Maduro ha lanzado iniciativas de carácter cultural dirigidas sobre todo a niños y adolescentes “para que paremos la fábrica de antivalores que crean la violencia”.

Argentina: Una Brújula Para el Oficialismo (y Otra para la Oposición) – por Nicolás Cachanosky

Argentina: Una Brújula Para el Oficialismo (y Otra para la Oposición) – por Nicolás Cachanosky

El

resultado de las elecciones PASO debieron ser como la crónica de una

muerte anunciada para el FPV (Frente para la Victoria.) ¿Realmente se

esperaban un triunfo luego de las históricas manifestaciones que han

tenido no sólo en suelo Argentino, sino alrededor del mundo? Difícil

encontrar una mejor ilustración al dicho “no hay peor ciego que el que

no quiere ver.” El kirchnerismo, que tan cerca se dice del pueblo, fue

incapaz de ver la derrota que le esperaba a la vuelta de la esquina.

El

resultado de las elecciones PASO debieron ser como la crónica de una

muerte anunciada para el FPV (Frente para la Victoria.) ¿Realmente se

esperaban un triunfo luego de las históricas manifestaciones que han

tenido no sólo en suelo Argentino, sino alrededor del mundo? Difícil

encontrar una mejor ilustración al dicho “no hay peor ciego que el que

no quiere ver.” El kirchnerismo, que tan cerca se dice del pueblo, fue

incapaz de ver la derrota que le esperaba a la vuelta de la esquina.No al Fomilenio

No al Fomilenio

La semana pasada, unos senadores gringos dijeron que estaban evaluando decir NO dar el Fomilenio II a El Salvador, ya que no veían avances claros en el combate a la corrupción y el crimen organizado. “Mágicamente” en 48 horas, en ese país avanzaron un caso de corrupción en obras públicas de ese país que llevaba años parado, arrestaron a varios —incluyendo a un ex viceministro de Obras Públicas— y hay varios con órdenes de captura, incluyendo un exministro de Obras Públicas de ese país y un empresario chapín. Como que los gringos sacaron un “látigo” —Fomilenio— y avanzaron casos de corrupción de alto impacto en ese país.

“Nicaragua altera los equilibrios regionales y amenaza la paz”

ENTREVISTA

"Managua está ostentando el apoyo de Moscú", afirma Enrique Castillo, canciller de Costa Rica

Álvaro Murillo

San José (Costa Rica)

El canciller costarricense Enrique Castillo.

El Gobierno de Costa Rica envió esta semana a su vecina Nicaragua la

nota de protesta número 21 desde que estalló un conflicto bilateral en

torno a la supuesta presencia de nicaragüenses en una isla costarricense

en la zona fronteriza caribeña. Este octubre se cumplen tres años de

una disputa que ha llevado a la presidenta Laura Chinchilla a declarar “enemigo” al gobierno de Daniel Ortega.

Costa Rica se queja de ser invadido por militares de Nicaragua, pero también de la falta de interés de la comunidad internacional ante el “expansionismo” de Ortega. Si existiera un ejército costarricense, Nicaragua ni se hubiera acercado, dijo el canciller Enrique Castillo en una entrevista con este diario, minutos antes de recibir una respuesta escrita de Managua: más conflicto.

Costa Rica se queja de ser invadido por militares de Nicaragua, pero también de la falta de interés de la comunidad internacional ante el “expansionismo” de Ortega. Si existiera un ejército costarricense, Nicaragua ni se hubiera acercado, dijo el canciller Enrique Castillo en una entrevista con este diario, minutos antes de recibir una respuesta escrita de Managua: más conflicto.

Maduro denuncia que EE UU le ha prohibido sobrevolar su espacio aéreo

El presidente venezolano asegura que seguirá adelante con sus planes de volar a China este fin de semana, aunque se vea obligado a tomar una ruta más larga. Washington desmentió haber rechazado el permiso a Maduro

El presidente de Venezuela, Nicolás Maduro,

seguirá adelante con sus planes de volar a China, a pesar de que

Estados Unidos le haya negado el permiso para que su avión sobrevuele

Puerto Rico.

"Una cosa que es indignante que ha pasado hoy es que el gobierno de los Estados Unidos nos niega el sobrevuelo por la ruta del caribe por territorio de Puerto Rico (...) nos niega el permiso de sobrevuelo para nosotros ir a China, bueno yo he ordenado que hagan otra ruta aunque sea más larga", dijo Maduro durante un acto de Gobierno.

"Una cosa que es indignante que ha pasado hoy es que el gobierno de los Estados Unidos nos niega el sobrevuelo por la ruta del caribe por territorio de Puerto Rico (...) nos niega el permiso de sobrevuelo para nosotros ir a China, bueno yo he ordenado que hagan otra ruta aunque sea más larga", dijo Maduro durante un acto de Gobierno.

Las lluvias en México dejan 97 muertos

Una de las carreteras dañadas en Guerrero. / SCT (EFE)

El ciclón Manuel toca tierra en el noreste del país. Peña Nieto cancela su participación en la Asamblea General de la ONU

La tormenta Manuel embistió esta mañana Sinaloa, en la costa pacífica

mexicana y a 1.500 kilómetros al noroeste de Acapulco, uno de los

principales focos de la tragedia que azota a México desde el sábado. El

fin de semana pasado dos ciclones —Manuel e Ingrid— golpearon al país

por ambos costados y dejaron a su paso al menos 97 muertos, 68

desaparecidos, 50.000 evacuados y cientos de miles de damnificados en

todo el país.

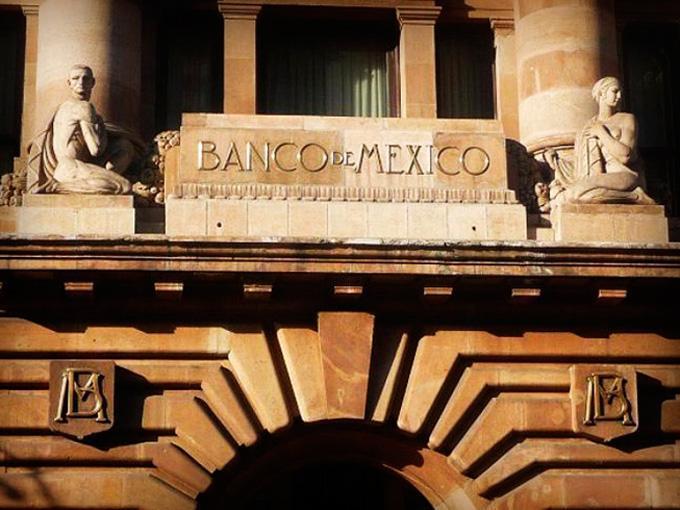

Diez puntos clave de la minuta de la reunión de Banxico

Todos los miembros coincidieron en que se

acentuó la desaceleración de la actividad económica mexicana en el

segundo trimestre del año

Diez puntos clave de la minuta de la reunión de Banxico

Banxico vota de forma dividida recortar tasa de 4 a 3.75%

Tres miembros de la junta de Gobierno del Banco

de México apoyaron la rebaja en la tasa a un nuevo mínimo, pero los

otros dos buscaban dejarla sin cambios

Publicado por Reuters

Publicado por Reuters

Banxico vota de forma dividida recortar tasa de 4 a 3.75%

Publicado por ReutersTres miembros de la junta de Gobierno del Banco de México apoyaron la rebaja en la tasa a un nuevo mínimo, pero los otros dos buscaban dejarla sin cambios, según la minuta del anuncio del 6 de septiembre.

Sin embargo, la mayoría consideró que la postura monetaria es congruente con la convergencia de la inflación al objetivo del banco central, del 3% más/menos un punto porcentual.

Excepcionalidad estadunidense

Hay una enraizada tradición en ciertos sectores de pensamiento en Estados Unidos, sobre todo ultraconservadores, que reclaman la excepcionalidad de su país por encima de todos los demás, en función de sus orígenes como nación independiente y de la forma de gobierno que adoptó: republicana, democrática y federal.

¿Y dónde metió la cabeza Ebrard?

Se sabe que el ex jefe de Gobierno capitalino anda feliz y campante paseando por el mundo y en sus ratos libres conociendo el país, con el propósito de que la gente del interior sepa quién es y qué busca políticamente.

Tragedias, reconstrucción y corrupción

¿Se alertó a tiempo?

La fuerza de la naturaleza, sobre todo la de los huracanes, es implacable.

La fuerza de la naturaleza, sobre todo la de los huracanes, es implacable. Imposible hacerles frente cuando llegan. Arrasan, destruyen.

Associated Press

Associated Press

No hay comentarios.:

Publicar un comentario